Last Updated on June 24, 2023 by Ryan

The Straight Line Depreciation Equation for a Luxury Car is calculated by subtracting the estimated salvage value of the car from its original cost and dividing that amount by the number of years it will be in service. The formula looks like this: (Original Cost – Estimated Salvage Value) / Number of Years = Annual Depreciation Expense. For example, if you purchase a luxury car for $50,000 and estimate it will have a salvage value of $10,000 after five years then your annual depreciation expense would be calculated as follows: ($50,000 – $10,000) / 5 = $8,000/year.

This equation allows businesses to accurately determine how much they should budget each year to cover their depreciable assets such as luxury cars.

When it comes to luxury cars, depreciation can be a real issue. Calculating the amount of depreciation for a luxury vehicle can be complicated but the straight line equation makes it much simpler. The straight line depreciation equation is used to determine how much value a car loses over time based on its purchase price and expected usage life.

This simple calculation will help you budget your finances and plan ahead when making decisions about purchasing or selling a luxury car.

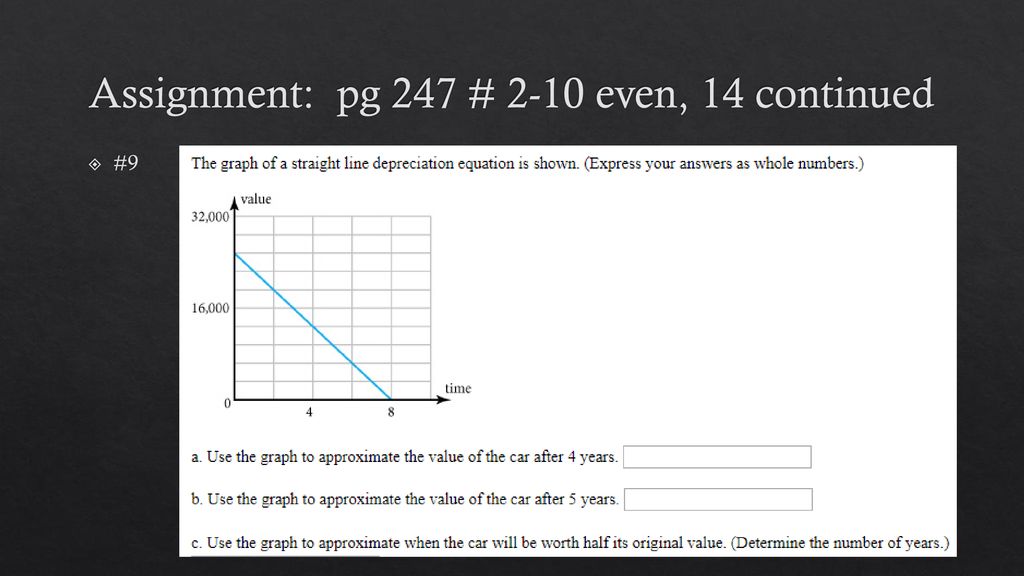

Linear Equation App: Car Depreciation

What is the Straight Line Depreciation Equation for a Motorcycle?

The straight line depreciation equation for a motorcycle is the same as any other form of depreciation. It is calculated by taking the cost of the motorcycle, subtracting its salvage value, and then dividing it by its useful life in years. For example, if you purchased a used motorcycle with a purchase price of $20,000 and an estimated salvage value at 5 years of $7000 then your straight line depreciation would be ($20,000 – $7000) / 5 =$3200 per year.

This number can then be used to calculate how much depreciation you will get each year on that particular asset.

What is the Equation for the Depreciation of a Car Given?

The equation for the depreciation of a car is essentially the same as calculating any asset’s depreciation. It takes into account an asset’s initial cost, its expected salvage value, and its useful life to determine what the periodic (monthly or yearly) depreciation will be. The formula looks like this: Depreciation = [(Initial Cost – Salvage Value) ÷ Useful Life] x Periods.

For example, if a car has an original cost of $20,000 with a 5 year useful life and estimated salvage value of $2,500 then it would depreciate at ($20,000 – $2,500)/5 = $3200 per year over five years.

How Do You Calculate Depreciation in Straight Line Method?

When calculating depreciation using the straight-line method, you will need to calculate the total cost of an asset, subtract its salvage value at the end of its useful life, and then divide that number by the number of years in its useful life. For example, if a piece of equipment costs $100,000 with a five-year useful life and a salvage value of $10,000 at the end of that time period: ($100,000 – $10,000) / 5 = $18,000/year. This means that each year for five years you would record depreciation expense on your financial statements for $18,000.

What is Straight Method of Depreciation?

The straight method of depreciation is an accounting technique used to allocate the cost of a tangible asset over its useful life. It’s also known as the fixed-rate or fixed-declining balance method. Under this approach, the same amount of depreciation is applied each year for the expected lifespan of the asset.

This calculation is based on either a predetermined percentage rate or a flat dollar amount per period depending on what’s most appropriate given situation and preference. The depreciable base under this method is usually calculated as original cost minus estimated salvage value, which means that only part of an asset’s total cost may be eligible for depreciation expense recognition in any given period.

Credit: quickbooks.intuit.com

The Straight Line Depreciation Equation for a Luxury Car is Y=-3400 X + 85000

The Straight Line Depreciation Equation for a Luxury Car is Y=-3400X+85000, which means that if you have a luxury car worth 85,000 dollars at the beginning of its useful life then it will depreciate by 3400 dollars each year. This type of depreciation calculation allows an owner to calculate the value of their asset over time and can be used to plan for future expenses related to ownership.

The Straight Line Depreciation Equation for a Car is

The Straight Line Depreciation Equation for a Car is used to calculate the depreciation of a car over time due to factors such as age, usage, and wear and tear. This equation takes into account the initial cost of the vehicle plus any associated taxes or fees at purchase in order to accurately estimate how much value will be lost over a given period of time. The equation also accounts for any salvage value that may exist when you sell or trade-in your vehicle at some point in the future.

By using this equation, it is possible to get an accurate picture of what your car’s worth should be throughout its lifetime.

The Straight Line Depreciation Equation for a Motorcycle is

The Straight Line Depreciation Equation for a Motorcycle is typically used to calculate the depreciation of an asset, such as a motorcycle. It estimates the decline in value over time due to wear and tear or other factors. The equation takes into account the purchase price of the motorcycle, its expected life span, salvage value (if any), and annual depreciation rate.

This equation can help you determine how much money you should set aside each year to cover your motorcycle’s expenses, such as maintenance costs and repairs.

Conclusion

The Straight Line Depreciation Equation for a Luxury Car is an important tool for anyone who is looking to purchase a luxury car. It helps calculate the depreciation cost of the vehicle over time and can be used to determine how much money could be saved or lost in the long run. Knowing this equation can help make informed decisions when it comes to buying or selling a luxury car, which will ultimately lead to better financial decisions that benefit everyone involved.